1. Introduction

In the vast realm of the chemical industry,

sodium cyanide (NaCN) stands as a crucial and versatile chemical compound. With its unique chemical properties, it plays a pivotal role in numerous industrial processes. Sodium

cyanide is a white, water - soluble solid that belongs to the class of cyanide compounds. Its chemical formula, NaCN, represents a combination of sodium ions (Na+) and cyanide ions (CN-), which endow it with remarkable reactivity.

One of the most prominent applications of

Sodium Cyanide is in the extraction of precious metals, particularly gold and silver. This application has made it an indispensable component in the mining and metallurgy industries. In the gold - mining process, for example,

Sodium cyanide is used to selectively dissolve gold from ore through a process called cyanidation. The reaction between sodium cyanide and gold in the presence of oxygen forms a soluble gold - cyanide complex, which can then be further processed to recover pure gold. This method has been widely adopted due to its high efficiency and relatively low cost compared to other gold - extraction techniques.

Beyond the mining sector, sodium cyanide also finds extensive use in the chemical synthesis of various organic compounds. It serves as a key reagent in the production of pharmaceuticals, pesticides, and dyes. In pharmaceutical synthesis, it can be used to introduce the cyanide functional group into molecules, which is often a crucial step in the creation of complex drug structures. In the pesticide industry, sodium - cyanide - based compounds can be synthesized to develop effective pest - control agents.

As the global chemical industry continues to expand and diversify, the demand for sodium cyanide has been on a dynamic trajectory. Africa, with its rich natural resources and emerging industrial sectors, has emerged as a region of great significance in the global sodium - cyanide market. The continent's vast mineral reserves, especially in the areas of gold, silver, and other precious metals, have spurred the growth of the mining industry. This, in turn, has led to a substantial demand for sodium cyanide for metal - extraction purposes.

Moreover, as African countries strive to develop their manufacturing and chemical industries, the need for sodium cyanide in chemical synthesis and other applications is also expected to rise. In the following sections, we will delve deeper into the specific aspects of the sodium - cyanide market in Africa, exploring its current status, growth drivers, challenges, and future prospects.

2. Sodium Cyanide: An Overview

2.1 Definition and Properties

Sodium cyanide, with the chemical formula NaCN, is a white, crystalline solid that often appears as flakes, blocks, or granular particles. It has a molecular weight of approximately 49.01 g/mol. This compound is highly soluble in water, which is a crucial property for many of its industrial applications. For example, in the gold - mining process, its solubility allows it to form a solution that can effectively react with gold - containing ores. It also has the ability to dissolve in ammonia, ethanol, and methanol.

One of the most notable characteristics of sodium cyanide is its extreme toxicity. It has a faint bitter - almond smell, but this odor is not a reliable indicator of its presence, as some individuals are unable to detect it. Even a small amount, when ingested, inhaled, or absorbed through the skin, can be lethal. This toxicity is due to the cyanide ion (CN -) it contains. Once in the body, the cyanide ion binds to cytochrome c oxidase in cells, preventing the normal transfer of electrons in the respiratory chain and ultimately leading to cellular asphyxiation and tissue hypoxia.

In addition to its toxicity, sodium cyanide is a strong base - weak acid salt. Its aqueous solution is alkaline due to hydrolysis. When dissolved in water, it reacts with water molecules to produce hydroxide ions (OH -) and hydrogen cyanide (HCN) in a reversible reaction: NaCN + H₂O ⇌ NaOH + HCN. This hydrolysis property also has implications for its storage and handling, as it needs to be protected from moisture to prevent the release of the highly toxic hydrogen cyanide gas.

2.2 Production Methods

Andrussow Process : This is one of the most common industrial methods for producing sodium cyanide. It uses natural gas (methane, CH₄), ammonia (NH₃), and air as raw materials. First, the natural gas is purified to remove inorganic and organic sulfur compounds, and the ammonia is vaporized, while the air is filtered. The three gases are then mixed in specific ratios: typically, ammonia: methane: air = 1:(1.15 - 1.17):(6.70 - 6.80). The mixture enters an oxidation reactor with a platinum - rhodium alloy as the catalyst. At a high temperature of 1070 - 1120℃, a series of chemical reactions occur, resulting in the formation of a mixed gas containing about 8.5% hydrogen cyanide (HCN). After cooling, the residual ammonia in the gas is absorbed by sulfuric acid in an ammonia - absorption tower. Then, the gas is further cooled, and the hydrogen cyanide is absorbed by low - temperature water to form a 1.5% solution. This solution is then distilled in a distillation tower to obtain hydrogen cyanide with a purity of 98% - 99%. Finally, the hydrogen cyanide is reacted with a caustic soda solution, and through processes such as evaporation, crystallization, drying, and molding, sodium cyanide is produced. One of the advantages of the Andrussow process is its relatively high - yield production of hydrogen cyanide, which is a key intermediate for sodium cyanide synthesis. However, it requires high - temperature operation, which consumes a significant amount of energy, and the handling of flammable and explosive raw materials such as methane and ammonia poses certain safety risks.

Light Oil Pyrolysis Method : In this method, light oil (such as gasoline, mainly composed of C₅ - C₆ hydrocarbons) and ammonia are used as the main raw materials, with petroleum coke as a carrier and nitrogen as a protective gas. The light oil and ammonia are first vaporized and then mixed in an atomizer and pre - heated to 280℃. They then enter an electric - arc furnace where, at a high temperature of 1450℃ and under normal pressure, they undergo a cracking reaction. The reaction produces a cracking gas containing 20% - 25% hydrogen cyanide. The gas is then subjected to a series of treatments, including dust removal, cooling to 50℃, and absorption by a 30% caustic soda solution. When the sodium cyanide content in the solution reaches 30% or more, it is considered a liquid sodium - cyanide product. The tail gas is further absorbed by a 20% caustic - soda solution. The light - oil pyrolysis method has the advantage that the light oil is relatively stable in nature, and with petroleum coke as a carrier, the reaction temperature can be maintained high. The process utilization rate of light oil can reach 100%, and the yield of liquid ammonia can be over 90%. It also adopts a closed - loop production system with continuous production and micro - negative - pressure operation, which helps to ensure safe and leak - free operation. However, the production process involves multiple steps of handling inflammable, explosive, and highly toxic substances, so strict safety measures are required.

Ammonia - Sodium Method : This process involves adding metal sodium and petroleum coke in a certain proportion to a reactor. The reactor is heated to 650℃, and then ammonia gas is introduced. The temperature is further raised to 800℃, and the reaction proceeds for 7 hours. During this time, the metal sodium is completely converted into sodium cyanide. After the reaction, the reactants are filtered at 650℃ to remove excess petroleum coke. The remaining molten substance is then cast and formed to obtain the sodium - cyanide product. Although the ammonia - sodium method is a relatively straightforward process in terms of reaction steps, it has some limitations. The high - temperature operation requires a large amount of energy input, and the use of metal sodium, which is a highly reactive metal, also brings certain safety risks during production and handling.

Cyanide Melt Method : Cyanide melt and lead oxide are added to an extraction tank at a ratio of (500 - 700):1. The addition of lead oxide helps to remove sulfur through the formation of PbS precipitate. After the extraction solution settles, the clear liquid contains 80 - 90 g/L of NaCN. This solution is then reacted with concentrated sulfuric acid in a generator to produce hydrogen - cyanide gas. The gas is cooled and dehydrated, and then enters an absorption reactor where it is absorbed by a caustic - soda solution to form sodium cyanide. The cyanide - melt method has the advantage of being able to utilize cyanide - containing raw materials in the form of cyanide melt. However, the use of lead - containing compounds in the process may cause environmental pollution problems if not properly handled, and the multi - step process also requires careful operation and control to ensure product quality and production efficiency.

3. The Global Sodium Cyanide Market Landscape

3.1 Market Size and Growth Trends

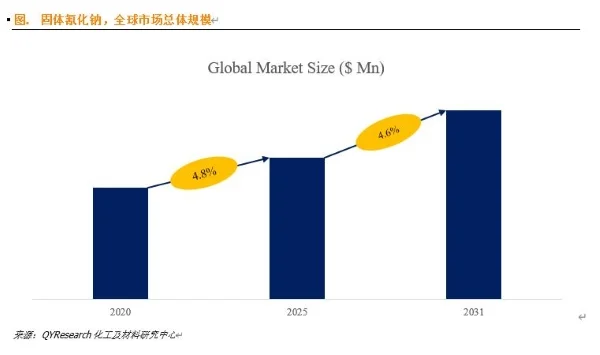

The global sodium cyanide market has been on a dynamic growth trajectory in recent years. In 2023, the market size was approximately 25.42 billion US dollars, according to market research firm QYResearch. This growth can be attributed to the compound's extensive applications in various industries, with the mining and chemical sectors being the primary drivers.

Over the past few years, the market has shown a steady upward trend. From 2018 to 2023, the market size increased at a compound annual growth rate (CAGR) of around 3.2%. This growth was mainly spurred by the continuous expansion of the mining industry, especially in the extraction of gold and silver. As the demand for precious metals grew, so did the need for sodium cyanide, which is a key reagent in the cyanidation process for metal extraction.

Looking ahead, the market is expected to continue its growth. Projections suggest that by 2030, the global sodium - cyanide market size will reach approximately 29.93 billion US dollars, with a CAGR of 3.6% from 2024 - 2030. The growth in the coming years will be further fueled by the growth of emerging economies, where industrialization and infrastructure development are driving up the demand for metals and, consequently, the need for sodium cyanide in metal extraction and chemical synthesis processes.

4. Africa's Mining Sector: A Key Driver

4.1 Abundant Mineral Resources

Africa is a continent rich in mineral resources, often referred to as the "world's mineral resource museum." It is home to a vast array of metals and minerals, with significant reserves of gold, diamonds, cobalt, aluminum, iron, coal, and copper, among others. These resources play a crucial role in the global mining industry.

Gold, for example, is one of the most prominent minerals in Africa. The continent has a long - standing history of

gold mining, and its gold reserves are substantial. In 2021, the total gold production in Africa reached 680.3 tons, with a growth rate of approximately 0.5% compared to the previous year. By 2022, the production had increased to around 3,000 tons, with more than 21 countries in Africa involved in gold mining. This makes Africa the world's third - largest gold - producing continent. Ghana, in particular, is the second - largest gold - supplying country in Africa and one of the largest in the world, with a gold production of about 90 tons in 2022.

Diamonds are another significant resource in Africa. Countries like South Africa, Botswana, and the Democratic Republic of the Congo are major diamond - producing nations. Botswana, for instance, is known for its high - quality diamonds, and the diamond industry contributes significantly to its economy. The Jwaneng diamond mine in Botswana is one of the largest and most productive diamond mines globally, with a high diamond - recovery rate.

Cobalt is also abundant in Africa, especially in the Democratic Republic of the Congo. This country accounts for a large proportion of the world's cobalt production. Cobalt is a crucial metal in the production of rechargeable batteries for electric vehicles and electronic devices. With the growing global demand for these products, the importance of African cobalt in the global supply chain has increased significantly.

Africa's iron - ore reserves are also substantial. The West African region, in particular, has rich iron - ore deposits. Guinea's Simandou iron - ore mine is one of the world's largest and highest - grade iron - ore projects. The mine's high - quality iron ore, with an average iron content of over 65%, has attracted significant international investment, and its development has the potential to transform Guinea's economy and impact the global iron - ore market.

4.2 Growth of the Mining Industry in Africa

In recent years, the mining industry in Africa has been on a growth trajectory, with several countries leading the way.

South Africa, with its rich natural resources, has long been a major player in the global mining industry. The country's mining sector is diverse, with significant production of coal, gold, platinum, and other minerals. South Africa is one of the world's largest coal - producing countries, with an annual production of over 250 million tons. Although about 75% of the coal is used domestically to meet nearly 80% of the country's energy needs, and more than 90% of the coal consumed in the entire African continent is produced in South Africa. In 2021, South Africa's coal production was 5.55 exajoules, a nearly 5% decrease from the previous year. Despite this decline, the country's coal - mining industry remains crucial.

In terms of gold mining, South Africa has a long and storied history. Before 2007, it was the world's leading gold - producing country. However, due to the stagnation of the mining industry in recent years, production has declined significantly. In 2022, South Africa produced approximately 110 tons of gold. The country is home to some of the world's largest and deepest gold mines, such as the South Deep gold mine, Kromdraai gold mine, Mponeng gold mine, East Rand gold mine, and Tautona gold mine. These mines have complex geological conditions and require advanced mining technologies and high - cost operations.

Ghana's mining industry has also been growing rapidly. Gold mining is a major economic driver in the country, contributing more than 40% of its total export revenue. The country's gold production has been steadily increasing over the years. The growth can be attributed to several factors, including improved mining technologies, increased investment, and favorable government policies. For example, the government has implemented policies to attract foreign investment in the mining sector, providing incentives such as tax breaks and simplified licensing procedures. This has led to the entry of many international mining companies, bringing in advanced technologies and management experience.

Mali is another African country where the mining industry has seen significant growth. Gold is Mali's most important export product, accounting for more than 80% of its total exports in 2023. The country is estimated to have 800 tons of gold ore, 2 million tons of iron ore, 5,000 tons of uranium, 20 million tons of manganese, 4 million tons of lithium, and 10 million tons of limestone. The development of the mining industry in Mali has not only increased the country's export revenue but has also created a large number of employment opportunities, both directly in the mines and in related service industries such as transportation and equipment maintenance.

In addition to these countries, other African nations like Burkina Faso, Tanzania, and Côte d'Ivoire are also experiencing growth in their mining sectors. Burkina Faso, for example, built its first gold refinery in 2023, which is expected to produce about 400 kilograms (880 pounds) of gold per day. This refinery not only improves the country's ability to process and add value to its gold production but also strengthens its position in the global gold - mining industry.

4.3 The Role of Sodium Cyanide in Mining

Sodium cyanide plays a pivotal role in the mining industry, especially in the extraction of precious metals, with gold extraction being a prime example.

The process of using sodium cyanide to extract gold from ore is called cyanidation. First, the ore is crushed into fine powder using industrial machinery. This increases the surface area of the ore, making it more accessible to the chemical reactions that follow. Then, the powdered ore is added to a sodium - cyanide (NaCN) solution. In the presence of oxygen, a chemical reaction occurs: 4Au + 8NaCN+O₂ + 2H₂O = 4Na[Au(CN)₂]+4NaOH. In this reaction, gold molecules form a strong bond with NaCN, creating a soluble gold - cyanide complex, Na[Au(CN)₂]. This complex allows the gold to dissolve in the solution, separating it from the other components of the ore.

After the gold has been dissolved in the cyanide solution, the next step is to recover the gold. This is typically done using zinc. Zinc reacts with the gold - cyanide complex in the solution. The chemical reaction is 2 [Au (CN)₂]⁻+Zn = 2Au + [Zn (CN)₄]²⁻. Through this reaction, the cyanide molecules are separated from the gold, and the gold is transformed back into a solid state, ready for the subsequent 熔炼 (smelting) process. In the smelting process, the solid gold is further purified and melted to obtain high - purity gold ingots.

The use of sodium cyanide in gold extraction is highly valued because it significantly improves the metal - recovery rate. Compared to other methods, cyanidation can effectively extract gold from low - grade ores, which were previously considered uneconomical to mine. This not only increases the overall amount of gold that can be obtained from a given ore deposit but also extends the lifespan of gold mines. By enabling the extraction of gold from a wider range of ores, sodium - cyanide - based cyanidation has made a substantial contribution to the global gold - mining industry and the supply of gold in the global market. However, the use of sodium cyanide also comes with challenges, such as its high toxicity and potential environmental risks, which require strict safety and environmental - protection measures during its use in mining operations.

5. Sodium Cyanide Market in Africa

5.1 Current Market Status

As of 2024, the sodium cyanide market in Africa is estimated to have a market value of approximately 2.5 billion US dollars. This figure is influenced by various factors, including the region's booming mining industry and the growing demand for sodium cyanide in other sectors.

In terms of production, Africa has a relatively small - scale domestic production capacity. Currently, the annual production of sodium cyanide in Africa is around 150,000 tons. This is mainly due to the limited number of local production facilities and the complex and high - cost nature of sodium - cyanide production. However, the consumption of sodium cyanide in Africa is much higher than its domestic production. In 2023, the consumption of sodium cyanide in Africa reached approximately 280,000 tons. The gap between production and consumption is filled through imports from countries with large - scale sodium - cyanide production, such as China, the United States, and some European countries.

5.2 Market Demand and Applications

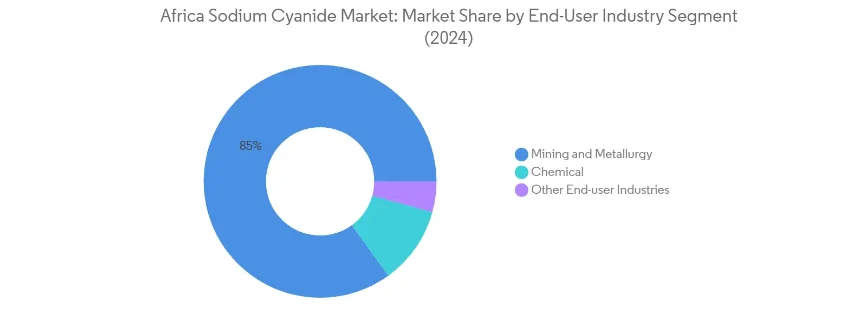

The primary area of demand for sodium cyanide in Africa is the mining industry, especially in gold mining. Given Africa's rich gold reserves and the significant growth of the gold - mining industry in countries like South Africa, Ghana, Mali, and Burkina Faso, the demand for sodium cyanide in this sector is substantial. In 2023, the mining industry accounted for approximately 85% of the total sodium - cyanide consumption in Africa. For example, in Ghana, with its large - scale gold - mining operations, the annual consumption of sodium cyanide in the mining industry is around 60,000 tons. The use of sodium cyanide in gold mining is crucial for the extraction process, as it enables the efficient separation of gold from ore, as described in the cyanidation process earlier.

Apart from the mining industry, sodium cyanide also has some applications in other sectors. In the chemical - synthesis industry, sodium cyanide is used as a reagent in the production of certain organic compounds. For instance, it can be used in the synthesis of nitriles, which are important intermediates in the production of pharmaceuticals and pesticides. Although the chemical - synthesis industry in Africa is not as developed as in some other regions, the demand for sodium cyanide in this area is gradually increasing. Currently, it accounts for about 10% of the total sodium - cyanide consumption in Africa.

The electroplating industry in Africa also utilizes sodium cyanide. In electroplating processes, sodium cyanide can be used to improve the quality and adhesion of metal coatings. However, due to the toxicity of sodium cyanide and the increasing environmental concerns, the use of alternative non - cyanide electroplating processes is also on the rise. The electroplating industry currently accounts for about 3% of the sodium - cyanide consumption in Africa, and this proportion may change in the future as more environmentally friendly electroplating technologies are adopted.

There are also some niche applications of sodium cyanide in industries such as metal heat treatment and the production of certain specialty chemicals. These applications, although relatively small in scale, contribute to the overall demand for sodium cyanide in Africa, accounting for approximately 2% of the total consumption.

5.3 Supply Side Analysis

Africa has a limited number of domestic sodium - cyanide producers. One of the notable local producers is a company in South Africa, which has an annual production capacity of about 30,000 tons. This company mainly serves the local mining industry in South Africa and has a market share of around 20% in the African sodium - cyanide market. The company's production process is based on the Andrussow process, with continuous efforts to improve production efficiency and product quality.

However, as mentioned earlier, the domestic production in Africa is far from meeting the demand. Therefore, imports play a crucial role in the African sodium - cyanide market. Africa imports a large amount of sodium cyanide from international suppliers. China is one of the major suppliers to Africa, accounting for about 40% of the total imports. Chinese suppliers, such as Hebei Chengxin Chemical, have a competitive edge in terms of price and product quality. Their advanced production technologies and large - scale production capacity enable them to offer sodium cyanide at relatively lower prices while maintaining high - quality standards.

Other significant suppliers to Africa include companies from the United States and Europe. Cyanco from the United States and some European chemical companies together account for about 30% of the total imports into Africa. These suppliers are known for their high - end production technologies and strict quality - control measures. They often supply sodium cyanide with specific purity requirements for high - end applications in the mining and chemical - synthesis industries in Africa. The remaining 10% of the imports come from other countries, such as South Korea and Australia, with each country contributing a relatively small but still significant portion to meet the diverse demands of the African market.

6. Challenges and Opportunities

6.1 Challenges

6.1.1 Regulatory Hurdles

Africa, as a continent with diverse countries and regions, has a complex regulatory environment for sodium cyanide. Different countries have established a series of strict regulations regarding the use, transportation, and storage of sodium cyanide. For example, in South Africa, the use of sodium cyanide in the mining industry is closely monitored by the government. Mining companies are required to obtain special permits before using sodium cyanide, and these permits are issued only after a comprehensive assessment of the company's safety management systems, storage facilities, and emergency response capabilities.

In terms of transportation, strict regulations govern the mode of transportation, packaging requirements, and the qualifications of transportation personnel. Sodium cyanide must be transported in specialized containers that meet high - safety standards to prevent leakage during transportation. The transportation vehicles are also required to be equipped with emergency response equipment and to follow specific transportation routes that avoid densely populated areas.

These regulations have had a significant impact on the sodium - cyanide market in Africa. Firstly, for mining companies, the high - threshold regulatory requirements mean increased operational costs. They need to invest more in safety facilities, personnel training, and compliance management to meet the regulatory standards. This may lead to some small - and medium - sized mining companies being unable to afford the costs, thus reducing the overall demand for sodium cyanide in the market. Secondly, the complex regulatory procedures can cause delays in the supply of sodium cyanide. For example, the process of obtaining a permit may take a long time, which can disrupt the normal production schedules of mining companies and affect their ability to plan and operate.

6.1.2 Environmental Concerns

Sodium cyanide is highly toxic, and its improper use and disposal can lead to serious environmental pollution. In the mining process, if there are leaks or improper handling of sodium - cyanide - containing solutions, it can contaminate soil, water sources, and air. When sodium cyanide enters water bodies, it can quickly dissolve and release cyanide ions, which are extremely toxic to aquatic organisms. Even a small amount of sodium cyanide can cause the death of fish, aquatic plants, and other organisms, disrupting the ecological balance of water bodies.

In 2024, a mining - related accident in a certain African country involving sodium cyanide led to the pollution of a nearby river. The cyanide - contaminated water killed a large number of fish in the river, and the local fishing industry was severely affected. The local government had to invest a large amount of resources in water - quality monitoring and restoration efforts.

In addition, the environmental concerns have led to the introduction of more stringent environmental protection requirements. Mining companies are now required to adopt more advanced waste - treatment technologies to ensure that the sodium - cyanide - containing waste is properly treated before being discharged. They need to install wastewater - treatment facilities to remove cyanide ions from the wastewater, and the treated water must meet strict environmental standards before being released. These environmental protection requirements have increased the operating costs of mining companies. They need to invest in the purchase and operation of advanced environmental - protection equipment, as well as in the research and development of more environmentally friendly mining processes. This, in turn, has put pressure on the sodium - cyanide market, as mining companies may be more cautious about using sodium cyanide due to the high environmental costs.

6.1.3 Competition from Alternatives

In recent years, there has been significant development in non - sodium - cyanide gold - extraction methods, which pose a threat to the sodium - cyanide market in Africa. One such alternative is the use of thiosulfate for gold extraction. Thiosulfate - based extraction methods have the advantage of being less toxic compared to sodium - cyanide - based methods. They are also more environmentally friendly, as they produce less harmful waste. For example, in some pilot - scale projects in African countries, thiosulfate has been used to extract gold from certain types of ores, and the results have shown relatively high gold - recovery rates.

Another alternative is the use of bio - leaching methods. This involves using microorganisms to extract gold from ores. Bio - leaching is a more sustainable approach as it does not rely on toxic chemicals like sodium cyanide. It can also be effective in treating low - grade ores that are difficult to process using traditional methods. Although bio - leaching is still in the development and experimental stage in many African countries, its potential for large - scale application in the future cannot be ignored.

The development of these alternative methods has had an impact on the sodium - cyanide market. As mining companies become more aware of the environmental and safety risks associated with sodium cyanide, they are increasingly interested in exploring alternative extraction methods. This may lead to a reduction in the demand for sodium cyanide in the long term. If the cost - effectiveness and efficiency of alternative methods continue to improve, they could gradually replace sodium cyanide in some gold - mining operations in Africa.

6.2 Opportunities

6.2.1 Growing Mining Activities

The mining industry in Africa is on an upward trend, and this growth is expected to drive the demand for sodium cyanide. As more countries in Africa are exploring and developing their mineral resources, the scale of mining activities is expanding. For example, in West Africa, the number of gold - mining projects in countries like Burkina Faso and Mali has been increasing in recent years. New mines are being opened, and existing mines are expanding their production capacity.

With the expansion of mining activities, the demand for sodium cyanide, a key reagent in the gold - extraction process, is likely to increase significantly. Mining companies will need more sodium cyanide to process the growing amount of ore. In addition, as the exploration for new mineral deposits continues, once new mines are put into production, the demand for sodium cyanide will also rise accordingly. This growth in the mining industry provides a broad market space for the sodium - cyanide market in Africa, and suppliers have the opportunity to expand their market share by meeting the increasing demand of mining companies.

6.2.2 Technological Advancements

Advancements in sodium - cyanide production technology and environmental - protection technology bring new opportunities to the market. In the field of production technology, new production processes are being developed to improve production efficiency and product quality while reducing production costs. For example, some companies are researching and applying new catalysts in the Andrussow process, which can increase the yield of sodium cyanide and reduce the consumption of raw materials and energy. This not only makes the production of sodium cyanide more cost - effective but also enables suppliers to offer more competitive prices in the African market.

In terms of environmental - protection technology, the development of more efficient wastewater - treatment and waste - management technologies for sodium - cyanide - related operations is crucial. New technologies can help mining companies better meet environmental regulations while using sodium cyanide. For instance, the development of advanced cyanide - removal technologies in wastewater treatment can reduce the environmental impact of sodium - cyanide use in mining. This, in turn, can ease the concerns of mining companies about environmental issues and encourage them to continue using sodium cyanide in their operations. Moreover, the development of these technologies can also attract more international investment in the African sodium - cyanide market, as investors are more likely to support projects that are both economically viable and environmentally friendly.

6.2.3 Strategic Partnerships and Investments

There is significant potential for international enterprises to form strategic partnerships with local African companies or make direct investments in the African sodium - cyanide market. International chemical companies, with their advanced technologies, management experience, and large - scale production capabilities, can collaborate with local African mining companies. For example, an international sodium - cyanide producer can partner with a local mining company in South Africa. The international company can provide high - quality sodium - cyanide products, advanced production technologies, and training for local employees, while the local mining company can offer its knowledge of the local market, access to mineral resources, and established local business networks.

Such partnerships can bring multiple benefits. They can help local mining companies improve their production efficiency and product quality, which is beneficial for the development of the local mining industry. At the same time, international companies can expand their market share in Africa through these partnerships. In addition, international investments can also help build new sodium - cyanide production facilities in Africa, reducing the region's dependence on imports and strengthening the local supply chain. This can create more job opportunities, promote local economic development, and contribute to the overall growth of the African sodium - cyanide market.

7. Future Outlook

7.1 Market Projections

Looking ahead, the sodium - cyanide market in Africa is expected to experience significant growth in the coming years. Currently valued at approximately 2.5 billion US dollars in 2024, it is projected to reach around 3.2 billion US dollars by 2030, with a compound annual growth rate (CAGR) of about 4.2% from 2024 - 2030.

This growth is primarily driven by the continuous expansion of the mining industry in Africa. As more exploration and development activities are carried out in the continent's rich mineral - bearing regions, the demand for sodium cyanide in gold and other metal - extraction processes will increase. For example, with the discovery of new gold deposits in West Africa and the planned expansion of existing mines, the need for sodium cyanide to process these ores is likely to rise steadily.

Moreover, as African countries strive to develop their manufacturing and chemical - synthesis industries, the demand for sodium cyanide in non - mining applications is also expected to contribute to the market growth. The development of local chemical - synthesis capabilities, especially in the production of pharmaceuticals and pesticides, will create new opportunities for the consumption of sodium cyanide.

7.2 Potential Developments

New Application Areas: In the future, sodium cyanide may find new applications in emerging industries in Africa. For instance, with the growing interest in the development of battery - related materials on the continent, sodium cyanide could potentially be used in the synthesis of certain battery - component materials. In the field of nanotechnology, which is also starting to gain traction in some African research institutions, sodium cyanide might be utilized in the preparation of nanomaterials with specific properties. Although these applications are still in the nascent stage, they have the potential to open up new markets for sodium cyanide in the long term.

Technological Breakthroughs: There is a high possibility of technological breakthroughs in sodium - cyanide production and utilization. In the production process, new catalysts or reaction conditions may be developed to improve the efficiency of the Andrussow process or other production methods. This could lead to lower production costs, higher product purity, and reduced environmental impact. In terms of utilization, research may focus on developing more efficient and environmentally friendly cyanidation processes in mining. For example, new additives or process modifications could be introduced to enhance the gold - extraction rate while minimizing the amount of sodium cyanide used and the generation of waste.

Market Structure Changes: The market structure of the sodium - cyanide market in Africa may also change. As local African companies gain more experience and technological capabilities, they may increase their production capacity and market share. This could reduce the continent's heavy reliance on imports. Additionally, more international companies may enter the African market through joint ventures or direct investments, leading to increased competition and potentially driving down prices while improving product quality and service levels. Strategic partnerships between local and international players may also become more common, enabling the sharing of technology, resources, and market access, which will reshape the competitive landscape of the African sodium - cyanide market.

8. Conclusion

In conclusion, the sodium - cyanide market in Africa is currently in a dynamic state, with both challenges and opportunities. The market is currently valued at around 2.5 billion US dollars in 2024, with a significant gap between domestic production and consumption, leading to a heavy reliance on imports.

The regulatory environment in Africa for sodium cyanide is complex and strict, which has increased the operational costs and supply - chain complexities for market players. Environmental concerns related to the toxicity of sodium cyanide have also put pressure on the market, as mining companies face higher costs for environmental protection and waste - treatment measures. Moreover, the emergence of alternative gold - extraction methods poses a threat to the long - term demand for sodium cyanide.

However, the future of the sodium - cyanide market in Africa also holds great promise. The growing mining activities in the continent, especially in gold mining, are expected to drive the demand for sodium cyanide. Technological advancements in production and environmental - protection technologies can help overcome some of the current challenges, making the use of sodium cyanide more efficient and environmentally friendly. Strategic partnerships and investments between international and local companies can also play a crucial role in the development of the market, strengthening the local supply chain and promoting market growth.

Overall, the sodium - cyanide market in Africa has significant potential in the global market. As the continent continues to develop its natural - resource - based industries and manufacturing sectors, the demand for sodium cyanide is likely to increase. With proper strategies to address the challenges and capitalize on the opportunities, the sodium - cyanide market in Africa can contribute significantly to the global chemical - industry landscape, driving economic growth and development in the region.

- Random Content

- Hot content

- Hot review content

Online message consultation

Add comment: