Introduction

Sodium cyanide (NaCN), a cornerstone of industries like mining and Pharmaceuticals, continues to shape global markets despite its toxicity. This article analyzes current demand drivers, challenges, and emerging trends that will define its future role in a sustainability-focused economy.

1. Current Market Demand

Key Applications

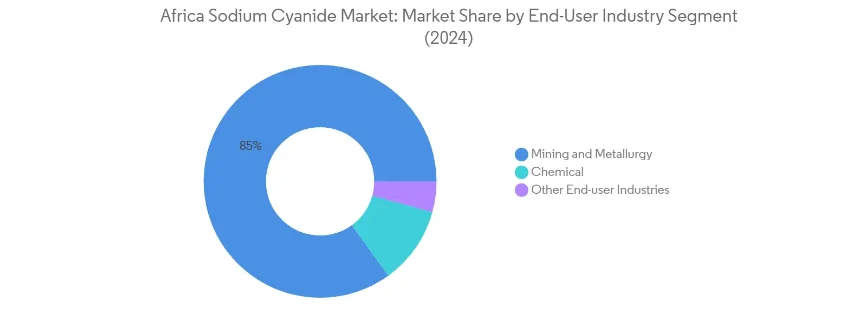

Gold Mining: Accounts for ~60% of global consumption. Gold’s enduring value and rising demand for electronics and jewelry sustain this use.

Pharmaceuticals: Used in drug synthesis (e.g., antivirals, cancer treatments), aligning with the $1.5 trillion global pharma industry.

Chemical Manufacturing: Critical for producing adiponitrile (nylon precursor) and agrochemicals.

Regional Dynamics

Asia-Pacific: Dominates production (China, India) due to robust mining and chemical sectors.

North America: Focused on regulated, high-purity applications in pharma and electronics.

2. Growth Drivers

Gold’s Safe-Haven Status: Economic uncertainty and central bank purchases boost gold prices, increasing mining activity.

Pharmaceutical Innovation: Rising R&D spending drives demand for specialty chemicals like Sodium Cyanide.

Industrial Expansion: Emerging economies’ infrastructure projects fuel steel, plastics, and agrochemical production.

3. Challenges and Risks

Environmental Pressures:

Leaks and spills (e.g., 2023’s Romanian mine accident) spark regulatory crackdowns.

EU’s REACH regulations restrict use in non-essential sectors.

Health Concerns: Occupational exposure risks prompt stricter safety protocols.

Alternative Technologies:

Thiosulfate Leaching: Gains traction in mining as a less toxic gold extraction method.

Biomimetic Catalysts: Reduce reliance on cyanide in organic synthesis.

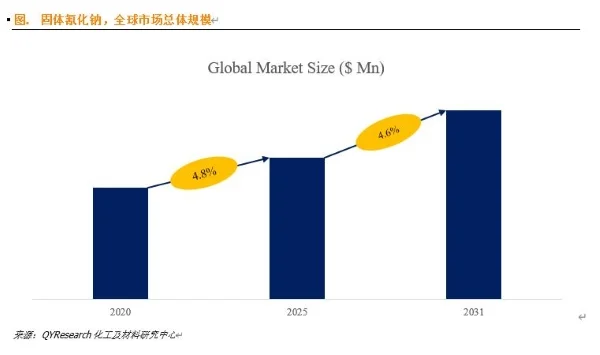

4. Future Outlook (2025–2030)

Trends Shaping the Market

Sustainability-Driven Innovation:

Investment in Green Chemistry (e.g., enzymatic cyanide degradation) to minimize environmental impact.

Adoption of Circular Economy models for cyanide recovery in mining.

Geopolitical Shifts:

U.S. and EU policies favor domestic, regulated production over imports from lax-regulatory regions.

Market Segmentation:

High-Purity Grades: Growth in pharma and semiconductors.

Technical Grades: Steady demand in mining, but slower growth due to 替代品.

5. Conclusion

While sodium cyanide faces mounting pressure from environmental and safety concerns, its indispensability in Gold Mining and high-tech industries ensures resilience. The market’s future hinges on balancing industrial utility with sustainability goals, likely through:

Regulatory harmonization to prevent misuse.

R&D collaboration for safer alternatives.

Digital tools (AI, IoT) to optimize usage and reduce waste.

- Random Content

- Hot content

- Hot review content

- Polyethylene Glycol PEG - 2000/4000/6000/8000 alcohol ethoxylate surfactant

- Dithiophosphate 25S

- Oxalic acid for mining 99.6%

- Potassium Permanganate – Industrial Grade

- Sodium Peroxide

- Cobalt Sulphate Heptahydrate

- Gold Ore Dressing Agent Safe Gold Extracting Agent Replace Sodium Cyanide

- 1Discounted Sodium Cyanide (CAS: 143-33-9) for Mining - High Quality & Competitive Pricing

- 2China's New Regulations on Sodium Cyanide Exports and Guidance for International Buyers

- 3Sodium Cyanide 98% CAS 143-33-9 gold dressing agent Essential for Mining and Chemical Industries

- 4International Cyanide(Sodium cyanide) Management Code - Gold Mine Acceptance Standards

- 5China factory Sulfuric Acid 98%

- 6Anhydrous Oxalic acid 99.6% Industrial Grade

- 7Oxalic acid for mining 99.6%

- 1Sodium Cyanide 98% CAS 143-33-9 gold dressing agent Essential for Mining and Chemical Industries

- 2High Quality 99% Purity of Cyanuric chloride ISO 9001:2005 REACH Verified Producer

- 3Zinc chloride ZnCl2 for High Molecular Weight Polymers Initiator

- 4High Purity · Stable Performance · Higher Recovery — sodium cyanide for modern gold leaching

- 5High Quality Sodium Ferrocyanide / Sodium Hexacyanoferr

- 6Gold Ore Dressing Agent Safe Gold Extracting Agent Replace Sodium Cyanide

- 7Sodium Cyanide 98%+ CAS 143-33-9

Online message consultation

Add comment: